Business Entity Conversion

Business Entity Conversion

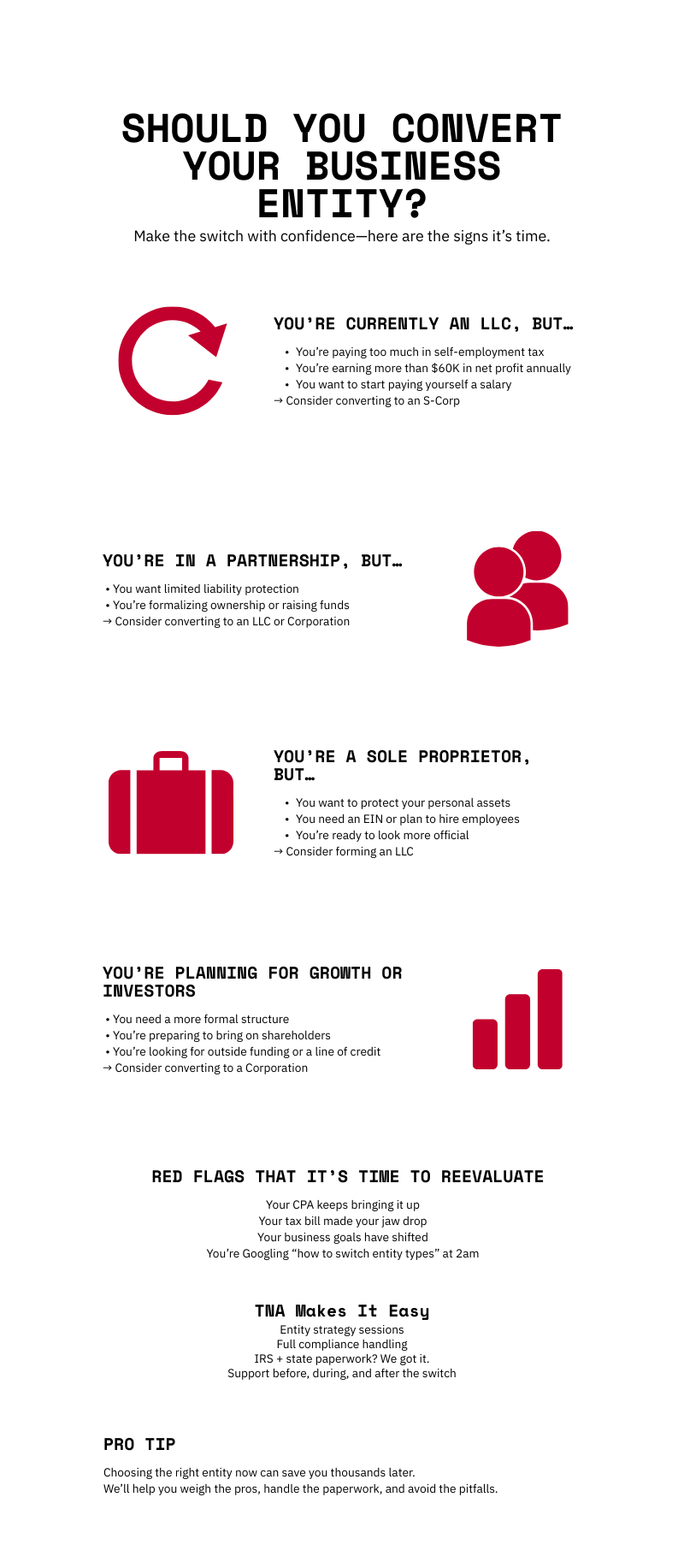

Your business has grown. Evolved. Matured. And now? It’s time your entity structure caught up.

At TNA Financial Services Group, we specialize in helping businesses convert to the entity type that best matches their current goals—not the ones they had three years ago. Maybe you’re shifting from an LLC to an S-Corp to save on self-employment taxes. Maybe you’re bringing on a partner and need to restructure. Maybe your accountant said, “It’s time.” Whatever the reason, we’ll help you make the move—with strategy, speed, and zero stress.

Entity conversion isn’t just a formality—it’s a turning point. And how you handle it can impact everything from taxes and liability to investor interest and future scalability.

Our Business Entity Conversion Services include:

- One-on-one consultation to determine if conversion is right for you

- Evaluation of tax implications and compliance requirements

- State-level conversion filings and compliance documentation

- IRS notifications and updated EIN records (if needed)

- Post-conversion guidance to make sure nothing slips through the cracks

- Fractional CFO Services

We don’t just file and forget—we stay with you throughout the process, translating legalese and tax code into plain English. We’ll tell you what matters, what doesn’t, and what to expect next.

Because business isn’t static—and your structure shouldn’t be either.

Need to evolve your business structure? We’ll help you do it right.

Let’s make your next chapter even stronger than your last.